On March 26, 2024, the Ontario Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 2 sections:

Personal Tax Changes

Business Tax Changes

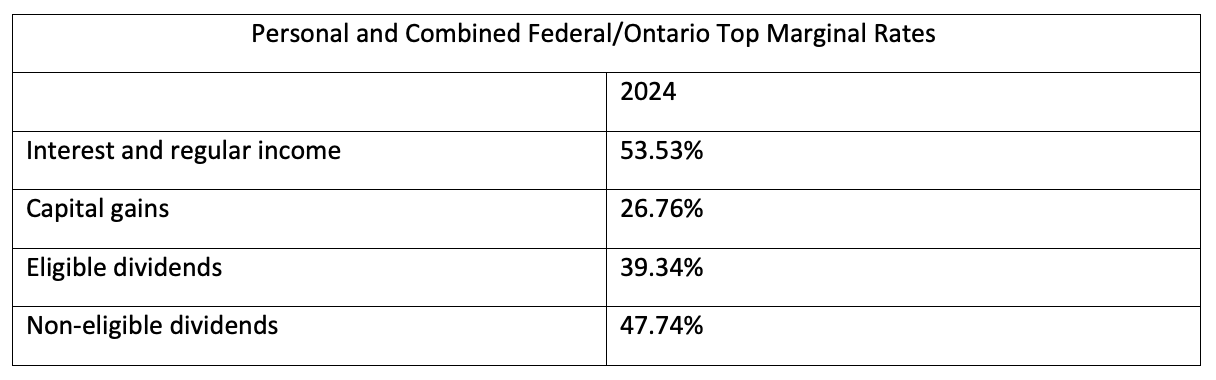

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, Ontario’s personal income tax rate remains as follows:

Gasoline tax and fuel tax

The Ontario government has chosen to extend the reduced tax rates on gasoline and fuel. This means that the tax you pay when you buy gas or fuel will remain at nine cents per litre until December 31, 2024, instead of ending on June 30, 2024.

Alcohol taxation and fees

The budget reveals that the government plans to review the taxes and fees on beer, wine, and alcoholic beverages.

Property assessment and taxation review

The budget says that Ontario will keep postponing property reassessments while it looks at how property assessments and taxes work. Ontario also plans to talk to different groups about property assessments starting in the early spring.

Housing supply and affordability

The budget says Ontario wants to make it easier for certain cities to:

Bring in a Vacant Home Tax

Give lower property taxes on new apartment buildings with many units for rent.

Technical amendments

The budget mentions that Ontario might suggest some small changes, like fixing how small estates are handled in the Estate Administration Tax Act of 1998 and adjusting how loans are dealt with during the day in Ontario.

Carbon tax referendum

The budget states that the provincial government plans to introduce a law that would ask the public to vote in a referendum before starting any new provincial carbon pricing program.

Tax system review

The budget states that the government is still looking at how taxes work in the province, which they started doing in the 2023 Ontario budget.

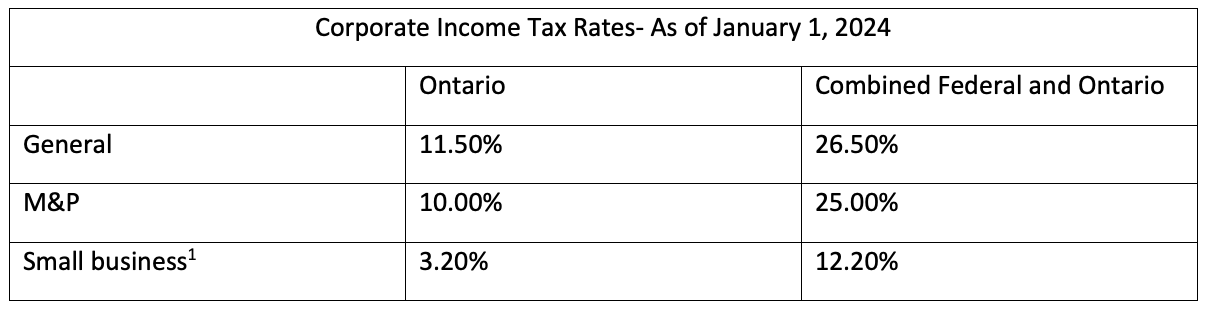

There are no changes to the province’s corporate tax rates in Budget 2024.

As a result, Ontario’s Corporate income tax rate remains as follows:

1 On first $500,000 of active business income.

Ontario computer animation and special effects tax credit

The budget is making changes to who can get the Ontario Computer Animation and Special Effects (OCASE) Tax Credit. Now, for each movie or TV show, a company must spend at least $25,000 on Ontario workers’ wages, with certain timing rules. Also, instructional videos, music videos, and gaming videos won’t count for the credit anymore.

These updated eligibility criteria replace the previous requirement for an eligible film or television production to also be certified for either the Ontario Film and Television Tax Credit or the Ontario Production Services Tax Credit.

The changes start for productions that begin computer animation or special effects work on or after March 26, 2024.

Wondering how this year’s budget will impact your finances or your business? We can help – give us a call today!

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.