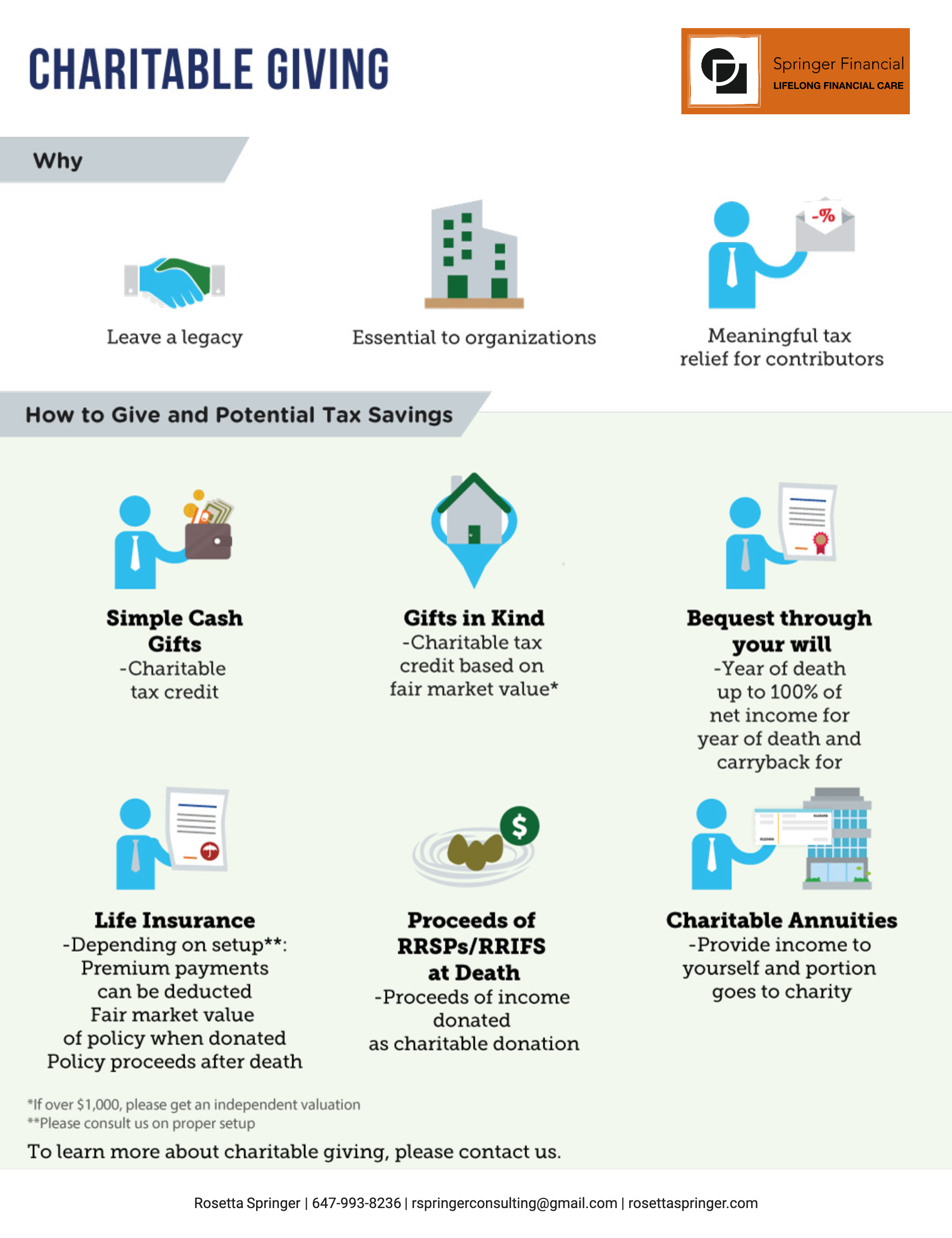

Why do individuals give to charity:

● Leave a legacy

● Essential to organizations

● Meaningful tax relief for contributors

There are many ways to give and lots of potential tax savings:

1. Simple Cash Gifts

– Charitable tax credit

2. Gifts in Kind

– Charitable tax credit based on fair market value, if the market value is over $1,000, it’s best to get an independent valuation.

3. Bequest through your will

– Year of death up to 100% of net income for year of death and carryback for year preceding death

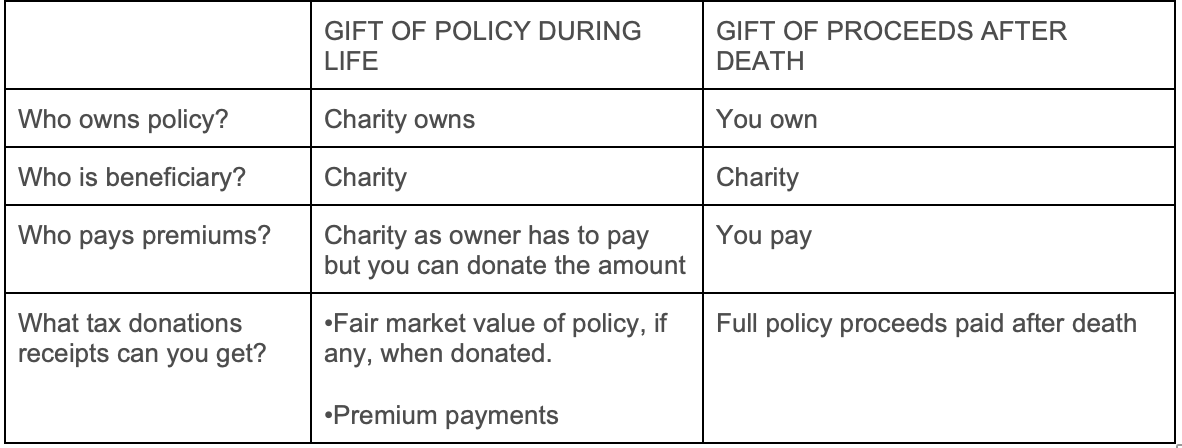

4. Life Insurance

Depending on setup:

5. Proceeds of RRSPs/RRIFS at Death

– Proceeds of income donated as charitable donation

6. Charitable Annuities

– Provide income to yourself and portion goes to charity

To learn more about charitable giving, please contact us.

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.