The 2019 budget for Ontario was announced by Vic Fedeli, Finance Minister, giving details of a deficit of $11.7 billion for 2018-19 and $10.3 billion for 2019-20. Below are details of the key changes in relation to personal and corporate finances.

Personal

The budget did not announce changes to personal tax rates.

Ontario Childcare Access and Relief from Expenses (CARE) tax credit

Effective the 2019 tax year, the budget introduces a new refundable Ontario Access and Relief from Expenses (CARE) personal income tax credit, beginning with the 2019 tax year.

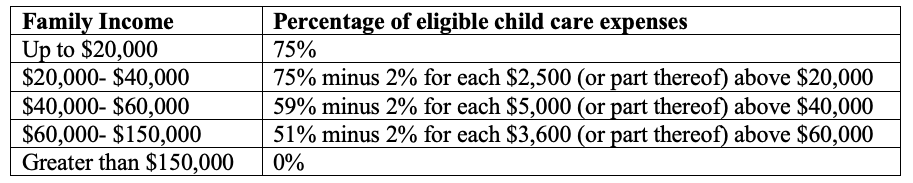

The tax credit will be based on the taxpayer’s family income and eligible child care expenses. It will provide the following tax credit per child up to:

$6,000 under the age of 7

$3,750 between age 7 to 16

$8,250 with a severe disability

The new credit will be calculated as the amount of eligible child care expenses multiplied by the credit rate shown below. The credit is eliminated when family income is greater than $150,000.

For 2019 and 2020, the taxpayers may claim the new tax credit on their tax returns. In 2021, Ontario intends to allow families to apply for regular advance payments.

Estate administration tax

Effective Jan 1, 2020 the budget eliminates the Estate Administration Tax on the first $50,000 of an estate’s value and extends the filing deadline of the Estate Administration Tax Information Return with the Ministry of Finance to 180 days (from 90 days) after the receipt of an estate certificate, and extends the deadline for filing amended information returns to 60 days (from 30 days).

Review of property tax assessment system

The province will review the property tax assessment system.

Addressing tax loopholes and tax integrity

The province has created a specialized unit of tax experts to find and address tax loopholes and abuse.

Corporate

The budget did not announce changes to the provincial corporate rate.

Ontario interactive digital media tax credit

The budget reduces the minimum Ontario labour expenditure to qualify as a specialized digital game corporation to $500,000 (from $1 million.)

Review

The budget will review the Ontario Innovation Tax Credit, other research and development incentives and cultural media tax credit certification process.

Please don’t hesitate to contact us if you have questions about how the budget will affect you.

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.