Financial advice for business owners is often two-sided: personal financial advice and advice for the business.

Business owners have access to a lot of financial tools that employees don’t have access to; this is a great advantage, however it can be overwhelming too. Solid financial advice can relieve this.

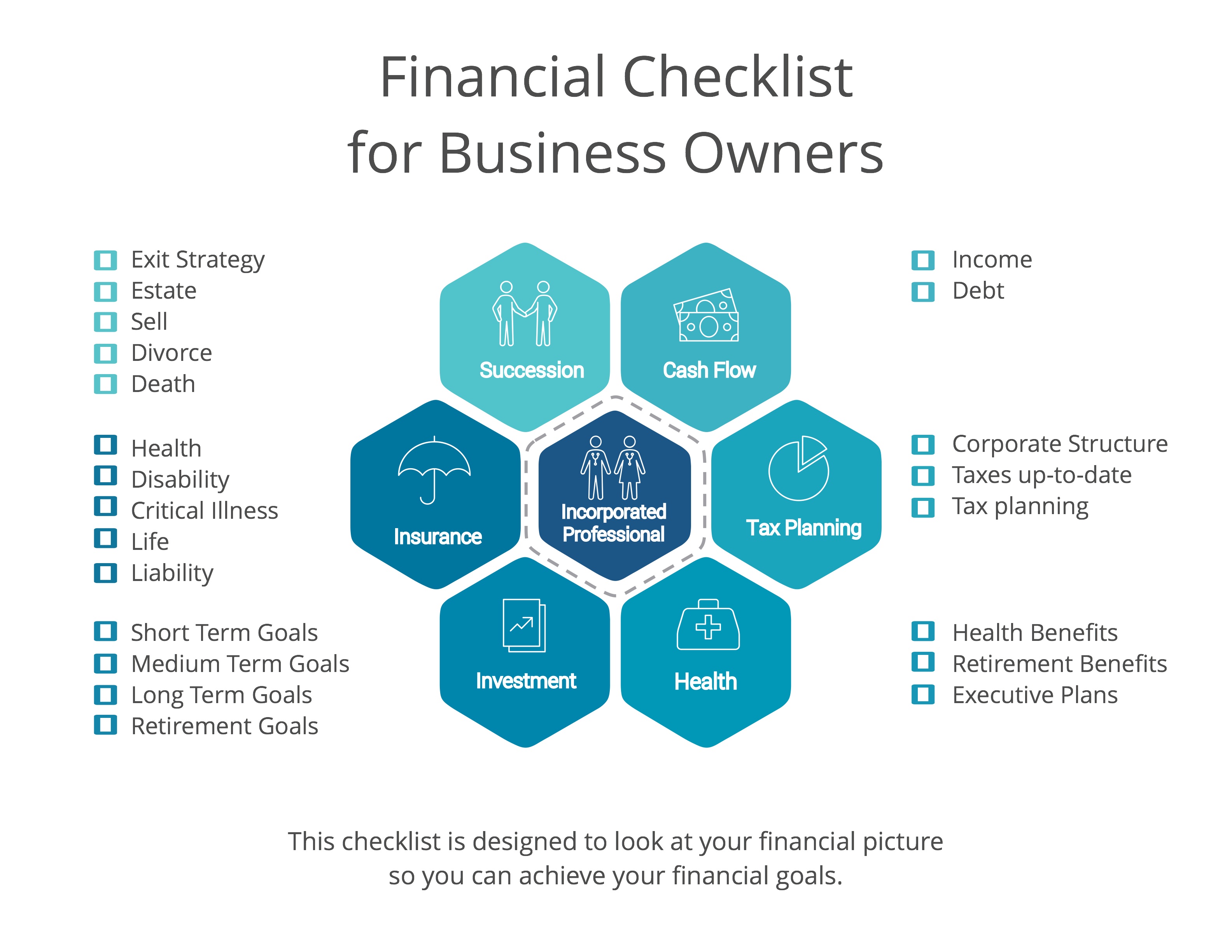

Financial advice looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them. For you, personally and for your business.

Worry less about money and gain control.

Organize your finances.

Prioritize your goals.

Focus on the big picture.

Save money to reach your goals.

For a business owner, personal and business finances are connected. Therefore both sides should be addressed: Personal and Business.

There are 2 main factors when it comes to business owners’ finances: Growth and Preservation

Growth:

Cash Management- Managing Cash & Debt

Tax Planning- Finding tax efficiencies

Retaining & Attracting Key Talent

Preservation:

Investment- either back into the business or outside of the business

Insurance Planning/Risk Management

Succession/Exit Planning

There are 2 main sides your financial advisor should address: Accumulation and Protection

Accumulation:

Cash Management – Savings and Debt

Tax Planning

Investments

Protection:

Insurance Planning

Health Insurance

Estate Planning

Establish and define the financial advisor-client relationship.

Gather information about current financial situation and goals including lifestyle goals.

Analyze and evaluate current financial status.

Develop and present strategies and solutions to achieve goals.

Implement recommendations.

Monitor and review recommendations. Adjust if necessary.

Talk to us about helping you get your finances in order so you can achieve your lifestyle and financial goals.

Feel confident in knowing you have a plan to get to your goals.

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.