This year’s tax deadline is April 30, 2022. We’ve got a list of tips to help you save on your taxes!

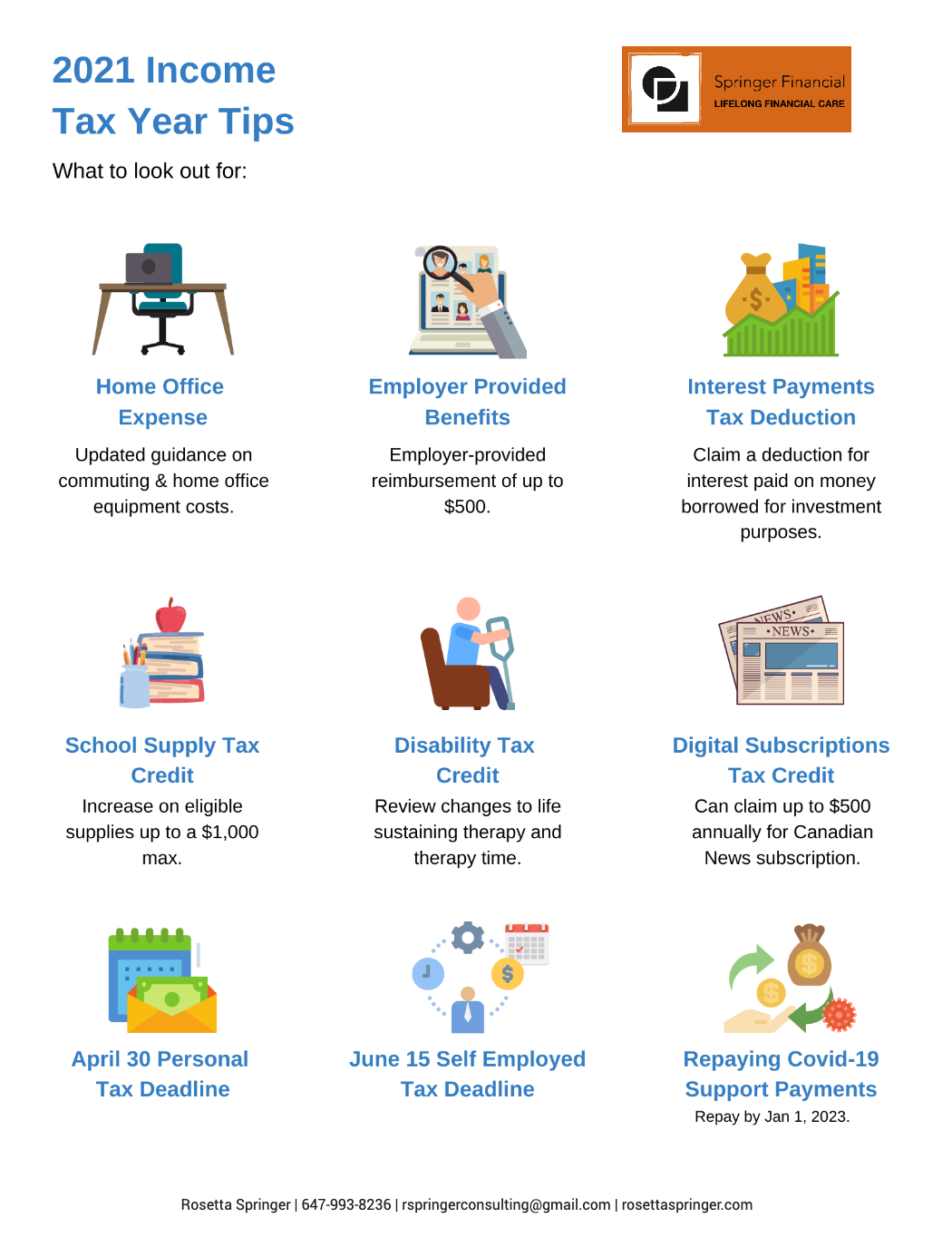

Claiming home office expenses

You can claim up to $500 under the “flat rate” method if you worked at home due to COVID-19. To claim more, you must use the detailed method to claim home office expenses.

Employer-provided benefits

If your employer reimburses you for certain costs (such as commuting costs, parking, and home office equipment) due to COVID-19, the CRA will generally not consider this a taxable benefit.

Repaying Covid-19 support payments

If you repaid COVID-19 benefits, you can deduct the amount on your tax return either for the year you received the benefit or the year you repaid it, or you can split the deduction between both years.

Climate Action incentive can no longer be claimed

As of 2021, this amount can’t be claimed as a refundable credit; instead, you’ll receive quarterly payments via the benefits system.

Disability tax credit (DTC)

If you or a family member are DTC claimants, then you should review the updated criteria for the tax credit in regards to mental functions, life-sustaining therapy and calculating therapy time.

Eligible educator school supply tax credit

This tax credit has been increased to 25 percent for eligible supplies (such as books and games) to a maximum of $1,000.

Tax deduction on interest payments

You can claim a tax deduction for the interest you’ve paid on any money you’ve borrowed to invest. However, you can only do this if you use the money to earn investment income (for example, a rental property).

The digital subscriptions tax credit

You can claim up to $500 as a tax credit if you have a digital subscription to a qualifying Canadian news outlet.

Self-employed? Be sure to set aside enough for personal income tax!

If you’re self-employed, be sure you put aside enough money (we recommend 25% of your income) to pay your tax bill when the time comes. You’re taxed only on your net income (total income minus expenses).

You need to plan ahead for tax changes if you want to retire abroad

Planning to retire abroad? If so, you need to be aware of the tax implications and plan accordingly. If you sell your house and move, you may be considered a “non-resident” and be subject to capital gains taxes on non-registered investments (even if you have not sold them) or have your pension subjected to a withholding tax.

You can stop making CPP contributions if you’re over 65 but plan to keep working

If you’re 65 and already collecting Canada Pension Plan (CPP) benefits but also still working, you may be able to stop making CPP contributions. To do so, you need to fill in the form CPT30.

Need help?

Not sure if you qualify for a credit or deduction? Give us a call – we’re here to save you money on your taxes!

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.