We’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything you need to know in one place!

We’ve provided information on:

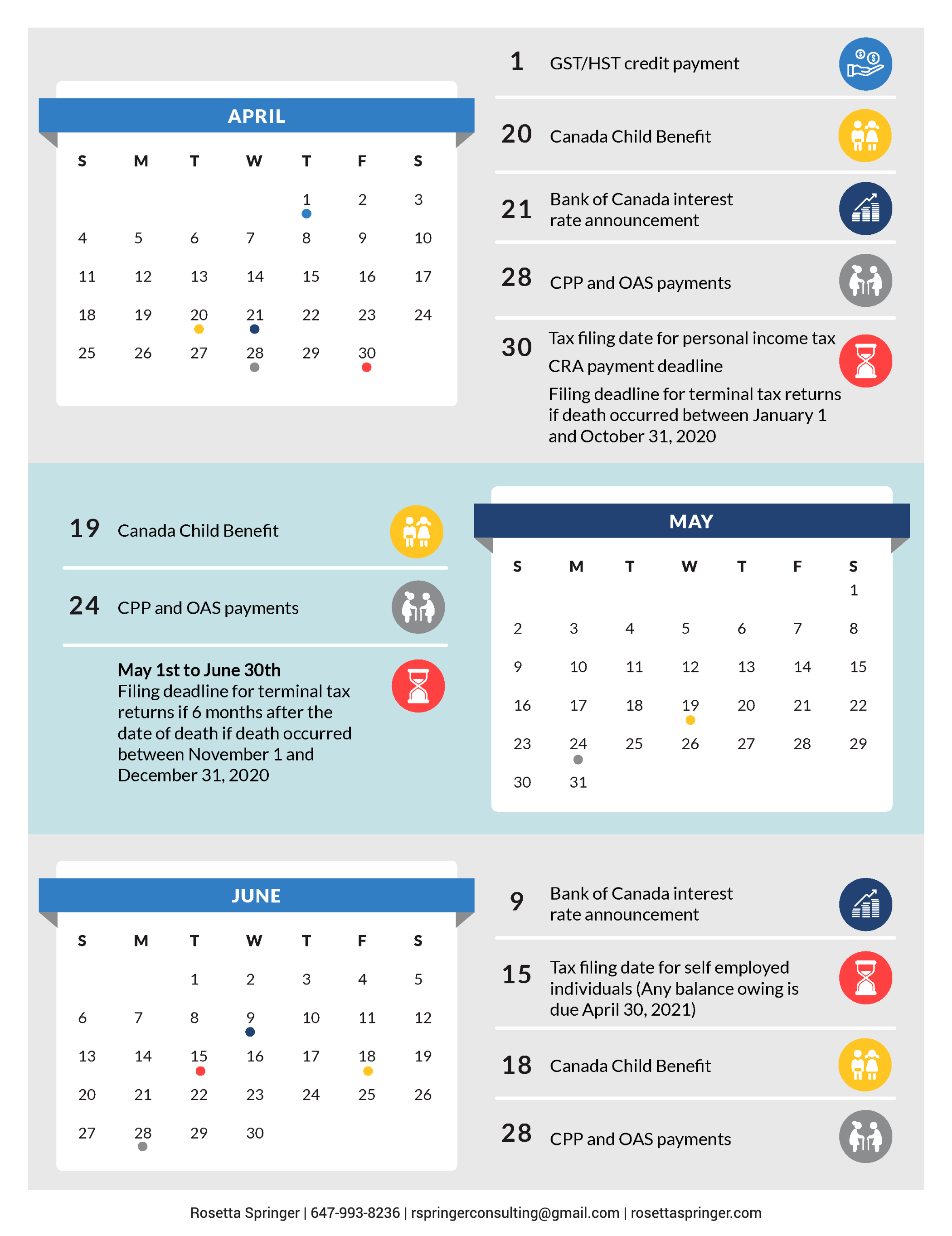

The dates when the government distributes payments for the Canada Child Benefit, the Canada Pension Plan (CPP) and Old Age Security (OAS).

When GST/HST credit payments are issued – usually on the fifth day of January, April, July and October.

All the dates the Bank of Canada makes an interest rate announcement. A change in this interest rate (up or down) can impact a bank’s prime interest rates. This can then affect anything from the interest rate charged on your mortgage and line of credit to how much the Canadian dollar is worth against other currencies.

When you can start contributing to your Tax Free Savings Account (TFSA) for 2021, the contribution limit for 2021 is $6,000.

March 1st is the last day for your 2020 Registered Retirement Savings Plan (RRSP).

December 31st , 2021 is the last day for 2021 charitable contributions.

December 31st is the deadlines for various investment savings vehicle contributions, including your Registered Disability Savings Plan (RDSP) and Registered Education Savings Plan (RESP), as well as your RRSP if you turned 71 in 2021.

Tax filing deadlines for personal income tax, terminal tax returns for someone who died in 2020, self-employed individuals

Knowing all of this information here can help you keep on top of your finances if you’re expecting any government benefits. It can also make sure you don’t miss any critical tax or investment deadlines!

Tax packages will be available starting February 2021 – reach out to your accountant to get started on your taxes!

If you have any questions on how we can help with your 2021 finances, please contact us.

Springer Financial

Rosetta Springer

Financial Advisor

647-993-8236

info@rosettaspringer.com

707 St. Clair Avenue Suite 520

Toronto, Ontario

M6C 4A1

Clients are always surprised at the simplicity of my financial solutions. In my experience, the real challenge lies in seeing the big picture and analyzing all the working parts. By delivering an approachable plan, I help my clients clarify the path to their goals. I feel lucky to do this work; I get to help people from all walks of life that are doing well in the world.